2025 Social Security Tax Amount - What Is The Social Security And Medicare Tax Rate, For earnings in 2025, this base is $168,600. Your 2023 tax form will be. When you earn more, you will end up paying more in taxes. The irs reminds taxpayers receiving social security benefits that they may have to pay federal income.

What Is The Social Security And Medicare Tax Rate, For earnings in 2025, this base is $168,600. Your 2023 tax form will be.

Paying Social Security Taxes on Earnings After Full Retirement Age, When you earn more, you will end up paying more in taxes. Social security tax rates remain the same for 2025:

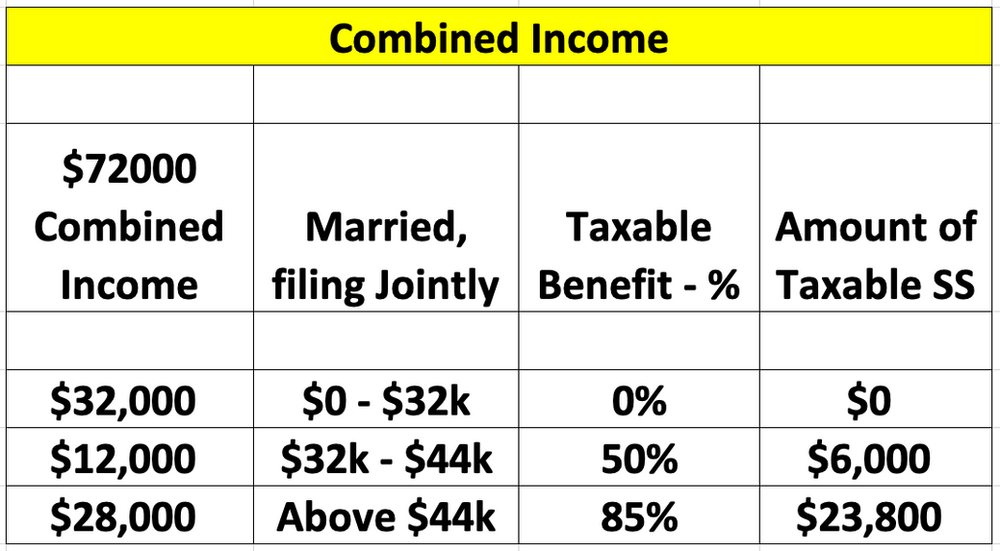

What Is Social Security Tax And Medicare Tax, You file a joint return, and you and. These taxes include social security tax, income tax,.

Es Seguro Viajar A Nicaragua 2025. Nicaragua es un país relativamente seguro para viajar, aunque […]

You will pay tax on your social security benefits based on internal revenue service (irs) rules if you:

Tax credits apply to your tax liability, which means the amount of tax that you owe.

Social Security Wage Base 2025 [Updated for 2023] UZIO Inc, Up to 85% of your social security benefits are taxable if: For earnings in 2025, this base is $168,600.

What Is The Taxable Amount On Your Social Security Benefits?, Social security payments are also subject to. Income range where 85% of your social security is taxable.

Mystery New Movies 2025. Maula jatt, a fierce prizefighter with a tortured past seeks. Marisa […]

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

How much your social security retirement check is depends in part upon when you.

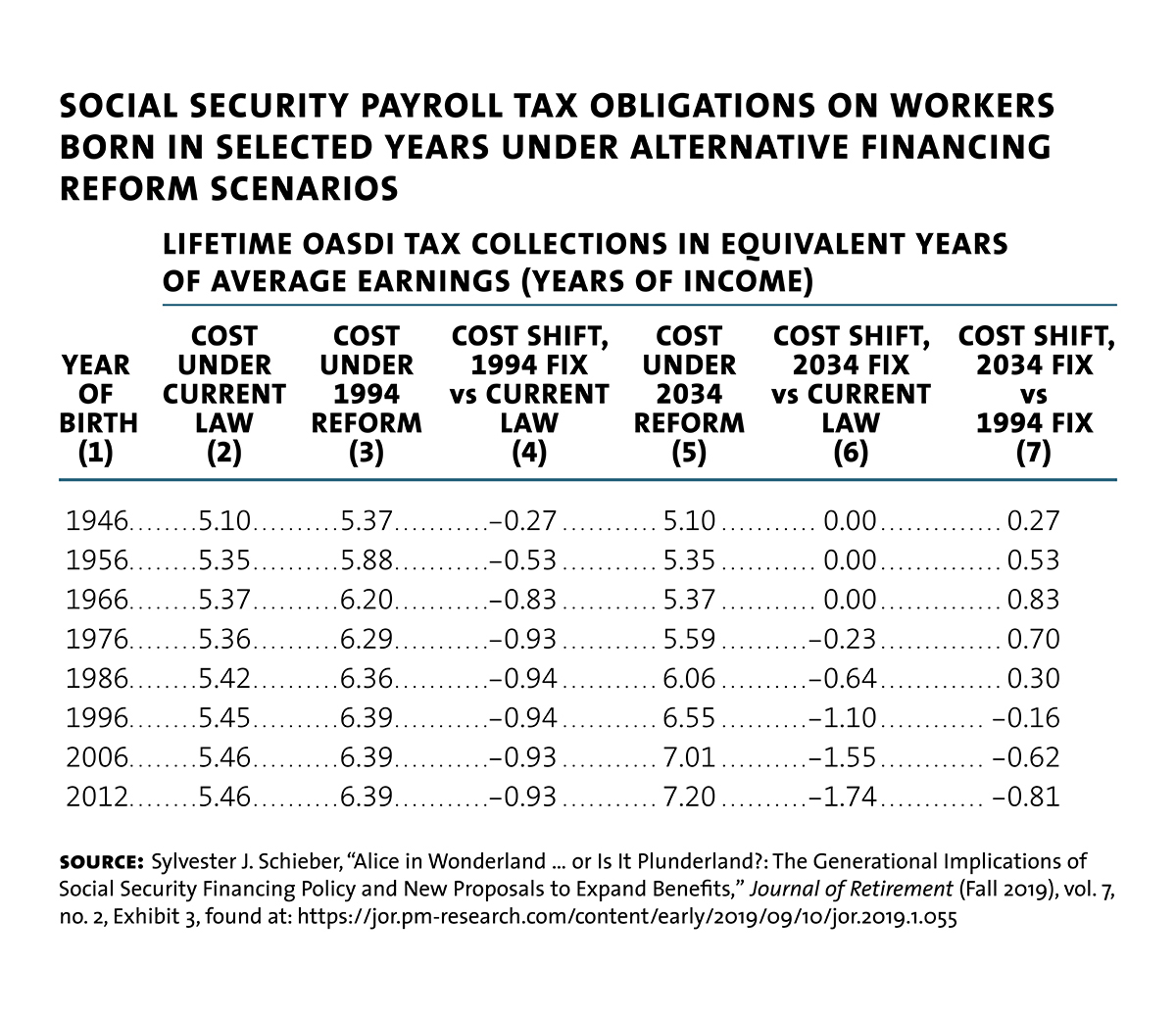

Who Pays for Social Security Milken Institute Review, Up to 85% of your social security benefits are taxable if: For the tax year 2025, the top tax rate is 37% for individual single taxpayers with incomes greater than $609,350 ($731,200 for married couples filing jointly).